Master Your Money and Mindset: What is a Strategic Emergency Fund?

This mini episode takes a brief dive into one of the most misunderstood tools in personal finance — the strategic emergency fund.

We’re dedicated to your financial well-being and to helping you achieve your financial goals.

Hear from our founder and how Barnum was transformed into what it is today.

Meet our leadership team and learn how they’re dedicated to achieving Barnum’s mission.

We’re dedicated to creating a culture of belonging, respect, and opportunity for all.

We’re committed to making a difference in the communities in which we work and live.

A complete list of every financial representative working with Barnum Financial Group

We’re proud to be recognized for our commitment to our clients and their financial success.

Many national and local media outlets have leveraged our knowledge and thought leadership.

Managing risks that could compromise your financial goals is vital.

Growing your wealth strategically is key to achieving goals like a happy retirement. Planning for your future includes carefully considering your investment options.

Every major financial decision you make impacts your retirement.

Switching jobs comes with a long to-do list that requires important financial decisions.

Legacy planning is more than just leaving money behind.

Considering the tax implications of individual, investment, or business decisions can help you pay less to the government.

A good education provides more than just a diploma or a degree; it’s the foundation of a solid future.

Providing your loved ones with the best possible quality of life requires patience, coordination, and careful planning.

Quisque vulputate velit magna, eget pellentesque tellus porttitor ac mauris velit

To thrive in the marketplace, you need more than just a strong work ethic and a great product or service.

Your employees are the backbone of your business. Show them you’re invested in their health and future with a competitive benefits program.

We offer educational opportunities to help you maximize financial opportunities and overcome financial challenges.

We have the knowledge and resources to assist you in every step of your financial journey.

Quisque vulputate velit magna, eget pellentesque tellus porttitor ac mauris velit

Key Findings, White Papers, Videos and more from our national research study

Access our blog offering relevant, useful, and educational content.

Check out our many financial educational events designed with you and your employees in mind.

This mini episode takes a brief dive into one of the most misunderstood tools in personal finance — the strategic emergency fund.

There are several strategies you can use to make the cost of disability income insurance coverage more affordable.

This episode deals with the importance of setting financial goals and why they matter, and how you can create a plan to achieve your goals.

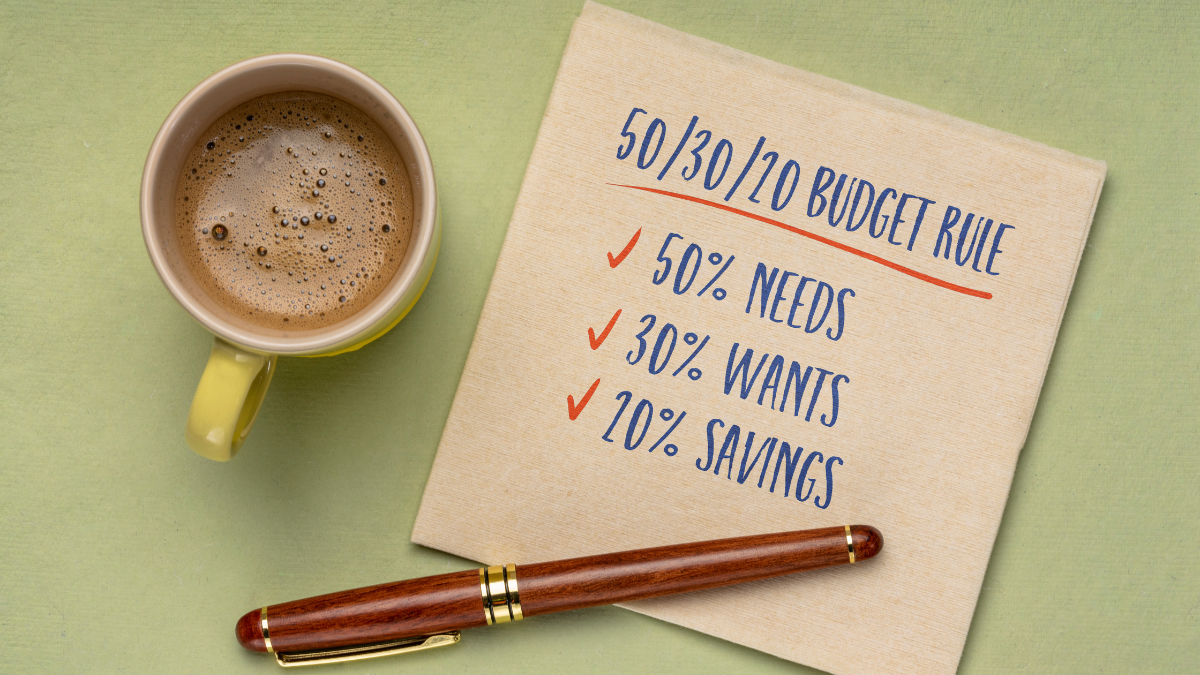

The 50/30/20 rule is a straightforward budgeting method that allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment.

Charitable donations not only lift those in need but also benefit the giver, including personal benefits and tax deductions.

Growth in investment doesn’t occur overnight. The Rule of 72 is one way to estimate the years it would take to double your investments.

Don’t let retirement surprises catch you off guard.

If you’re wondering where to start with your remodeling plans, here are several cost-effective home improvement projects for the fall season.

Financial anxiety is a pervasive and unsettling experience for countless individuals. It’s more than just occasional worry about bills.

Who We Are

Resources

What We Offer

Company

This comprehensive study dives into the evolving financial behaviors of American workers across a variety of factors, including generational, household income, gender, and employment status and more!