The Barnum Financial Group Study of Americans in the Workplace

About the Study

Barnum Financial Group is dedicated to empowering Americans in the workplace to achieve their financial goals. We understand the complexities of navigating today’s financial landscape, and we’re committed to providing the guidance and resources needed for success.

This comprehensive study dives into the evolving financial behaviors of American workers across a variety of factors, including generational, household income, gender, and employment status and more!

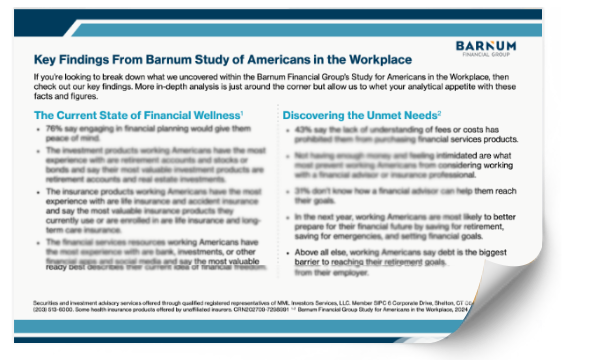

Key Findings

White Papers

Financial, Investment and Insurance Priorities Between the Generations

A focus on generational differences with regards to financial, investment, and insurance priorities.

Navigating Financial Decisions When Approaching Retirement

New National Research into Financial Considerations and Planning for Pre-Retirees 2024.

Priorities of High-Income Earners in the Current Financial Climate

A focus on working Americans with a household income of $150k+ per year.

Slide Decks

The Current State of Financial Wellness for Working Americans

An in-depth look at the working Americans experiences and value with investment and insurance products.

Discovering the Unmet Needs of Working Americans

Highlighting how financial professionals and financial products are viewed by working Americans.

Barnum Financial Group Study of Working Americans (Overall)

The overall, key findings from the study with the collected data across generations, income, and more!

Financial Freedom

- Comes from being debt-free.

- Is a comfortable retirement.

Investment Preferences

- Real Estate vs Cryptocurrency

- Stocks and Bonds

Future Planning

- Life Insurance

- Seeking Financial Advisors

Videos

Generational Differences in Financial Priorities

Life Insurance and Peace of Mind Across Generations

The Emotional Landscape Of Investing

Financial Goals And Concerns

Why Working, Americans May Seek Professional Help

Generational Differences In Access And Valuation Of Financial Resources

Unlock the Study