By Matthew Hemberger, Financial Advisor | Investment Advisor Representative

Pride Month is a joyful time of reflection for the LGBTQ+ community. All people who declare who they are to the world are festive warriors in the fight for equal rights. Being able to exist in a state of inclusion is a powerful feeling.

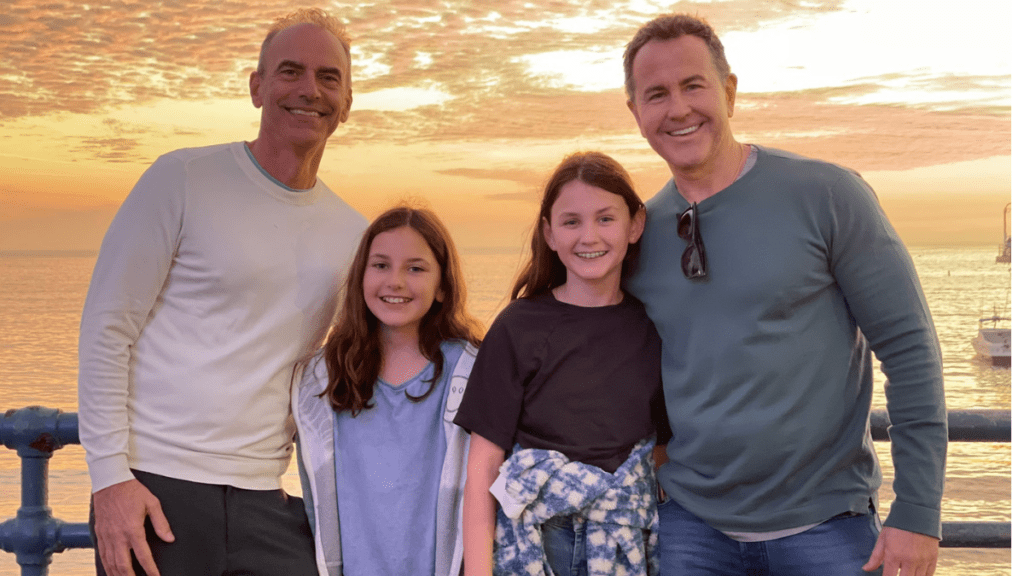

My husband and I wake up every day, get our two daughters ready for school, and then go to work. We are a vital and vibrant part of this society. We are gay men that live an ordinary family life. And we face the same issues that every family encounters, including how to get our finances in order.

As single men, when we first started our relationship, neither of us had any thoughts about financial planning. The idea of saving for family expenses, retirement planning, and legacy planning were foreign concepts. I’d like to think it’s because the idea of two men having a family was once unrealistic so there was no need to care about financial planning. But more likely, it’s because we were like most people — woefully uneducated about what to do with our money.

Once we began our family journey, we discovered one place where the LGBTQ+ community faced different hurdles from the heterosexual population was the cost of starting a family. There are significant costs when pursuing surrogacy, adoption, or IVF. We researched the costs involved, set aside the money needed and began the process. It’s imperative to understand the costs of starting a family because the expense of maintaining that family is yet to come. You don’t want to find yourself in debt before the child rearing costs begin.

We also discovered the gaps between what we wanted to do and how we were preparing to do it. We began with establishing legal documents, such as wills, powers of attorney and health proxies. In these areas, there are nuances that gay couples need to address. It’s vital to ensure that our intentions are carried out the way we mean them to be followed.

Once that was in order, we also reviewed our financial situation. We took a sober view of our earnings, spending, and what we were saving. With the help of a financial advisor, we established regular savings and investment plans. We also created plans for education and retirement which reflected our goals and risk tolerance. We established a comfortable amount of insurance and finally, created our legacy plans to help ensure our money was protected.

Our daughters are now 10 and 11 years-old and we are in a much better financial place now than when we started our family. We have achieved a more secure financial future for our children. Of course, it’s not as simple as it may have read. There were many ups and downs, but the process was made easier once we reflected on who we were and what we wanted.

So, during this Pride month, reflect on where you are in life, where you want to go and start your journey to plan for it.