There are a lot of articles aimed at people who realize as they grow closer to retirement, they will not be able to generate enough income in retirement to meet their needs. They include tips like:

- Delay retirement: 65 is just a number

- Reallocate your assets: consider investing more aggressively

- Spend less, save more

- Lower your standard of living

All of that is sound advice. But why put yourself in that position?

According to a 2018 blog post from MassMutual

About two out of three 21- to 32-year-olds haven’t started saving for retirement, says a report from the National Institute on Retirement Security.* And that’s a missed opportunity, because:

- The longer money works, the better the potential returns.

- Retirement saving offers a chance to reduce taxes.

- A nest egg increases options beyond retirement.

The last bullet really sets up the imperative to save and invest for the long-term as early as possible: you want options when you retire. The choice to travel, take up new hobbies, buy a vacation house, give money away to the people and causes you care about just to name a few.

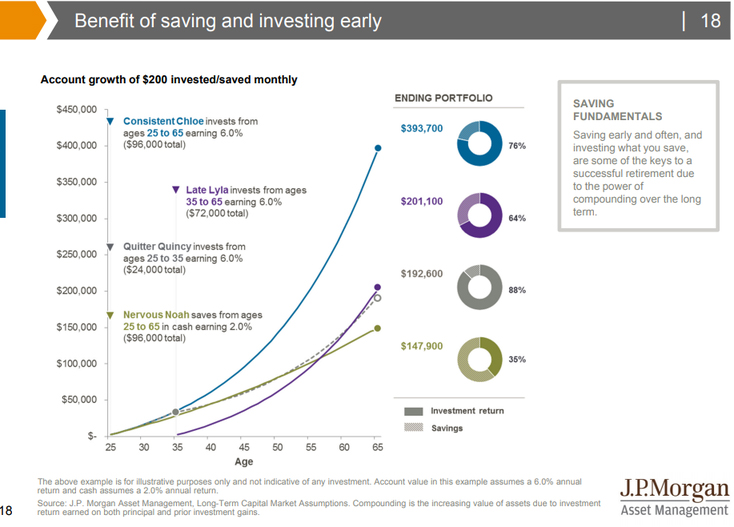

J.P.Morgan Asset Management publishes a Guide to Retirement that is a widely used resource throughout the industry. In the spirit of “a graphic is worth a thousand words; the chart below shows the substantial benefit of saving and investing early:

All things being equal, Nervous Noah seems the most likely to be in need of taking the actions we detailed at the opening of this piece, while Consistent Chloe looks like she will have the most flexibility to do what she wants to do when she retires. Whose place do you want to be in?

One of the most powerful ways to save is by contributing to an individual retirement account (IRA). It gives your money a chance to grow your deposits and can provide tax benefits. This is a perfect time to reflect on your retirement savings strategy. You still have until April 15, 2024, to make contributions for both the 2023 and 2024 tax years. Individuals under 50 can contribute up to $7,000 for each year, while those aged 50 or older can contribute an additional $1,000 catch-up contribution, making their limit $8,000 for each year. Remember, maximizing your IRA contributions early on takes advantage of compounding interest, which can significantly boost your retirement savings over time.

We encourage you to start saving early, save annually, invest intelligently, and plan for a fun retirement!