Nearly 65 million Americans take advantage of Social Security benefits, according to the Social Security Administration. Sound retirement planning is critical, and one way that many Americans secure part of their retirement income is through Social Security retirement benefits. As you plan for and near retirement, it can be helpful to understand how the program works and how it can fit into your retirement plan.

How It Works

The Social Security system is based on the following premise: Throughout your career, you pay taxes into Social Security. These Social Security taxes fund Social Security and Medicare benefits, according to MassMutual. In return, you receive certain benefits that can provide income to you when you need it most, such as when you retire or if you become disabled.

Keep in mind that Social Security should make up only a portion of your retirement plan. For many Americans, Social Security makes up at least 41% of their retirement income, according to MassMutual – the remaining income typically comes from other retirement savings tools, such as a 401(k) or an IRA, often sponsored by an employer. The Balance notes that “The distributions you receive from [a retirement savings account] don’t affect how much you’re entitled to receive in Social Security benefits each month.” Therefore, when planning for your retirement, you should consider both a savings plan and Social Security.

How to Qualify for It

Over the course of your career when you pay those Social Security taxes, you earn credits that help you to qualify for Social Security benefits. You can earn up to four credits per year, depending on the amount of income that you have. Most people need 40 credits (equal to 10 years of work) to be eligible for Social Security retirement benefits.

The amount of benefits that you receive depends on several factors, including your average lifetime earnings, your date of birth, and the type of benefit that you’re applying for. Family members, such as a spouse or a child, may also be eligible to receive benefits. The age at which you start receiving Social Security retirement benefits affects your benefit amount. Although you can retire early at age 62, the longer that you wait to retire (up to age 70), the higher your retirement benefit.

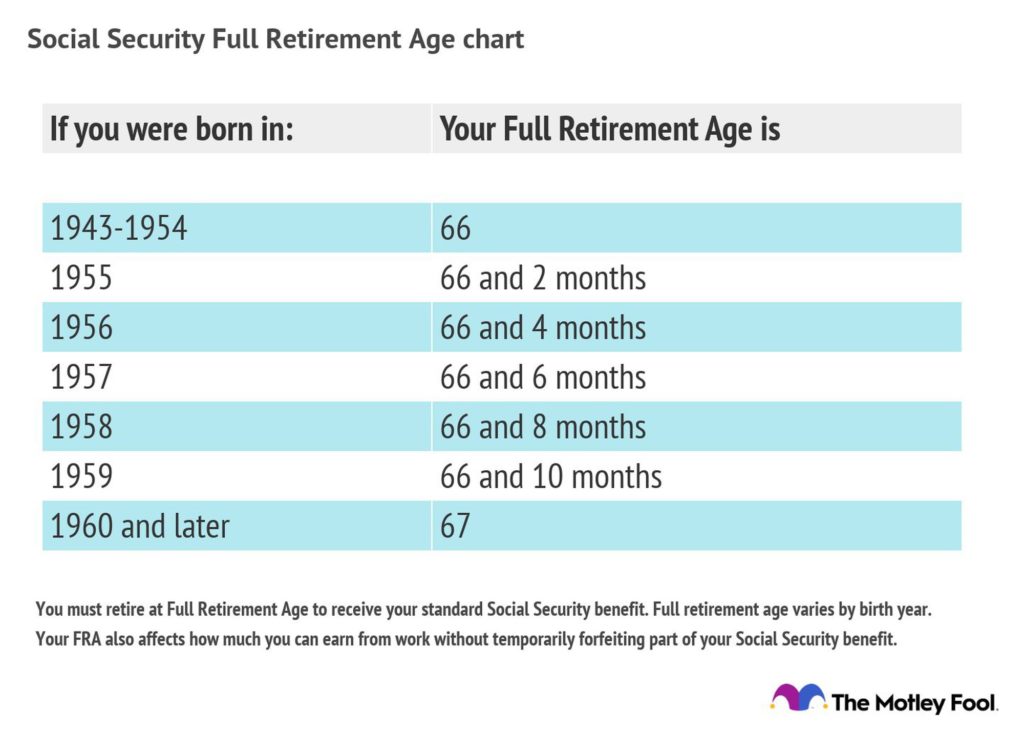

According to MassMutual, “Full retirement age is the age at which you are entitled to receive full Social Security retirement benefits” and is based on the year you were born (see the table below to find your full retirement age). If you choose to retire early, you’ll receive a reduced benefit. Alternatively, if you choose to delay retirement, you could receive benefits anywhere from 3% to 8% higher, depending on your date of birth (Social Security Administration). If you decide to continue working beyond age 70, you won’t receive any more credits.

Learn More About Social Security

If you’re nearing retirement, the Social Security Administration recommends applying at least three months before you’d like your benefits to kick in. You can head over to ssa.gov to fill out an application and learn more about the Social Security retirement benefits. Consider using the SSA’s Retirement Estimator, which estimates your benefit amount based on your Social Security earnings record – this can be super helpful even if you’re just beginning to think about retirement.

If you want even more resources, check out MassMutual’s Social Security Video Information Series which serves as a helpful tool for navigating the ins and outs of Social Security retirement benefits.